25+ Income payment calculator

Simply add the extra into the Monthly Pay section of the calculator. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members.

Early Retirement Calculator Omni Retirement Calculator Early Retirement Retirement

Ideally financial advisors recommend paying 20 down on your homes.

. A credit score of 640-679 with a down payment of 25 or more A debt-to-income ratio DTI up to 45 If one area of your application is weaker you can often compensate by being strong in other. Advance tax payment on non-TDS deducted income from self-employment professional service business capital gains or any other source require few simple steps. Plus if you name and save your entries under the Data tab you can quickly update the penalty interest on future billing statements just by changing.

Calculate ROI return-on-investment before and after taxes. Your lender will be able to provide you with a line-item breakdown of your mortgage payment. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

100 of the tax shown on your 2020 return 110 of that amount if you are not a farmer or a fisherman and the New York adjusted gross income NYAGI or net earnings from self-employment allocated to the MCTD shown on that return is more than 150000 75000 if married filing separately for 2021. You may not modify the interest rate here but you can do the same in offline PPF Excel CalculatorPPF account allows extension of scheme by 5 years which could be extended in last year of the scheme. Including loans bursaries grants student finance and paying back loans.

However your payments may instead be capped by the amount of a fixed payment on your loans over a 12-year term if this monthly payment amount is less than 20 of discretionary income. Surcharge is levied as follows. While the County of Hawaii charges an extra 025.

Payments made to an individual housing account intended for a down payment on a first home can also be subtracted up to 5000 single filers and 10000 joint filers per year and 25000 total. ICR generally limits payments to 20 of your discretionary income. A DTI of 12 50 or more is generally considered too high as it means at least half of income is spent solely on debt.

APR 249 - 824 399 - 824 249 - 824 Get My Rate View Details. This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR. In addition to calculating the late fee the calculator will also calculate the daily penalty interest rate and the total amount due.

529 Plan Ratings and Rankings. January 1 December 31. It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. This student loan Income-Based Repayment IBR calculator shows your monthly payment monthly savings and total amount of student loan forgiveness for IBR. Support for extra payments.

This Late Fee Calculator will help you to quickly calculate the interest penalty on overdue invoices. Income tax slabs and rates for resident individual age above 80 years Super senior citizen A cess at the rate of 4 per cent is added on the income tax amount. Advance tax payment of companies is usually carried out by their accounts section using challan 280.

The income tax rate in Illinois is 495 after an increase from 375 in 2017. Further surcharge is levied at different income tax rates if the total income exceeds Rs 50 lakh in a financial year. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

IBR caps your monthly payment at 15 of your discretionary income and offers forgiveness after 25 years of qualifying payments. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Illinois also has higher-than-average sales taxes and property taxes.

MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. How to Lower Debt-to-Income Ratio.

Such employee must serve under the same employer for a period of 12 months in a calendar year ie. Save Enough Down Payment. That makes it relatively easy to predict the income tax you will have to pay.

If debt level stays the same a higher. Based on Official Form 22A and expense and income standards published by the US Department of Justice Executive office of the US. Fixed APR includes a 025 discount when you enroll in autopay.

The Golden State fares slightly better where real estate is concerned though. California has among the highest taxes in the nation. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country.

Free Bankruptcy Means Test Calculator for your State and County. Applies all IRS Expense allowances and current State Median Income standards to give you an idea of whether you qualify for Chapter 7 bankruptcy. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 st January 2022 - 31 st December 2022.

A loan calculator that easily calculates the payment amount or term interest rate or the amount you can borrow. Individuals can pay advance taxes online or offline through challan 280. Besides checking your income debts and credit score its important to prepare enough down payment.

The PPF calculator shows data for PPF investment made for 15 years 20 years 25 years 30 years and 35 years at current year interest rate. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. Pay As You Earn PAYE limits your monthly.

You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. You must have filed a return for 2020 and.

Thats 15 of your income. The Income-Contingent Repayment plan is an income-driven repayment option for federal student loans. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan.

If you are seeking a loan for a format without a front-end limit you can set the front-end box to 100 for 100. Using a mortgage calculator. Using our calculator above.

Such employee must receive their employment income prescribed under Section 13 of the Income Tax Act 1967. Increase IncomeThis can be done through working overtime taking on a second job asking for a salary increase or generating money from a hobby. Hawaii Income Tax Calculator.

Your interest rate or monthly payment will not.

Printable Monthly Budget Planner Free Download Budget Planner Template Monthly Budget Printable Household Budget

Free 50 30 20 Budget Calculator For Your Foundation Template

How To Get Out Of Debt Fast The Science Backed Way Credit Card Payoff Plan Paying Off Credit Cards Good Credit

Financial Accounting Glyph Icon Financial Accounting Glyph Icon Accounting

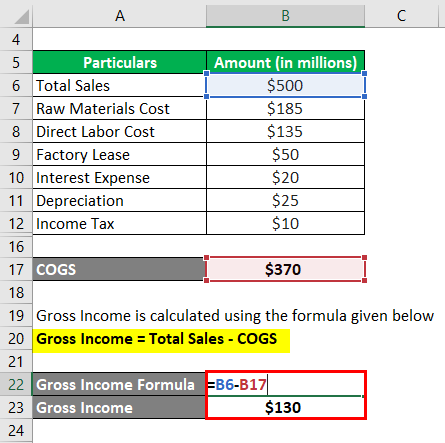

Gross Income Formula Calculator Examples With Excel Template

Mypoints Review 2022 Can You Redeem Points For Cash Life On A Budget Mypoints Make Easy Money

7 Free Printable Budgeting Worksheets Budgeting Budgeting Money Budgeting Worksheets

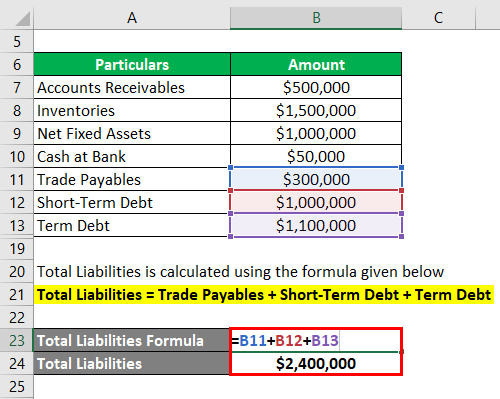

Net Worth Formula Calculator Examples With Excel Template

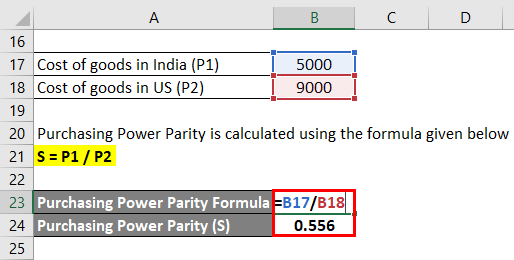

Purchasing Power Parity Formula Calculator Excel Template

Real Estate Calculator For Analyzing Investment Property Investment Property Real Estate Tips Investing

Gross Income Formula Calculator Examples With Excel Template

Intelligent Free Excel Budget Calculator Spreadsheet Download Personalize Personal Budget Template Budget Calculator Excel Budget

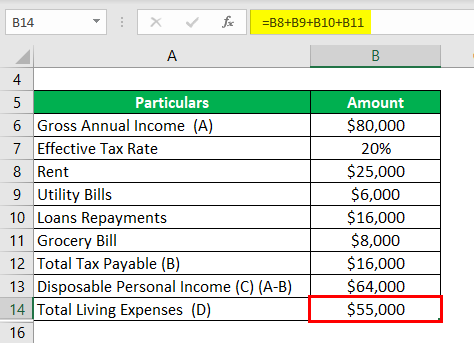

Disposable Income Formula Examples With Excel Template

25 Aesthetic Notion Templates Theme Ideas For 2022 Gridfiti Finance Tracker Notions Finance Dashboard

Tips For Creating A Budget Affordable Health Insurance Budgeting Budgeting Money

How To Calculate Gross Income Per Month

Living On A Low Income Successfully 25 Top Tips Budgeting Money Saving Money Budget Money Saving Strategies